$3.40 +0.0400 ( +1.20% ) 266.1K

NASDAQ: ASPI

Company Overview

ASP Isotopes is an isotope enrichment company utilizing technology developed in South Africa over the past 20 years to enrich isotopes of elements or molecules with low atomic masses. Many of these elements are unsuitable for enrichment using traditional methods such as centrifuges. The Company’s initial focus is on producing and commercializing highly enriched isotopes for the healthcare and technology industries.

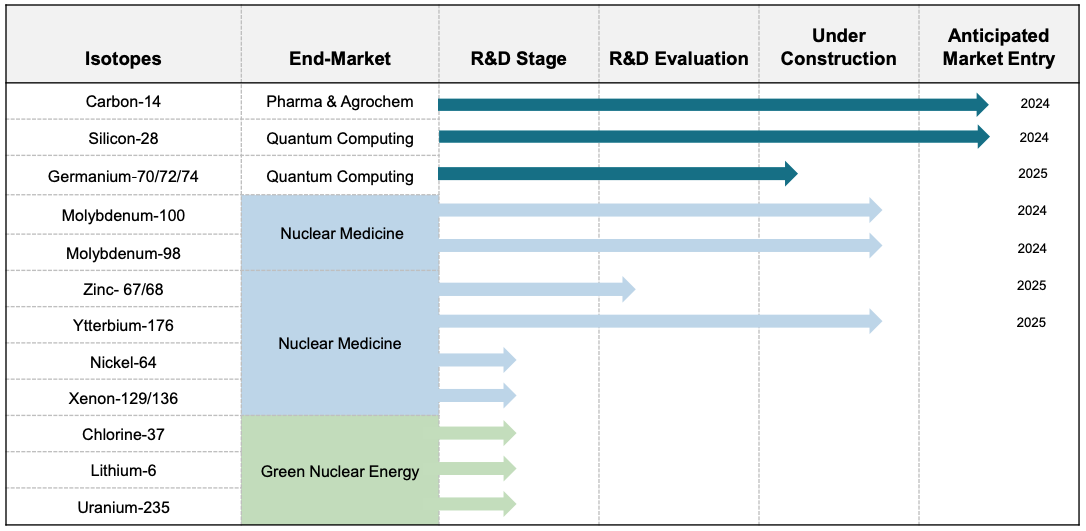

Development Pipeline

Value Proposition

ASP Isotopes’ advanced technology platform leverages 20 years of R&D history to enrich isotopes in varying levels of atomic mass. Its innovative technology will enable the company to manufacture a diverse range of isotopes, which will meet the growing demand in the Nuclear Medicine and Green Nuclear Energy industry. Favorable long-term market trends are expected to drive secular industry growth, and recent geopolitical events have created high urgency for companies and countries to search for reliable sources of isotopes.

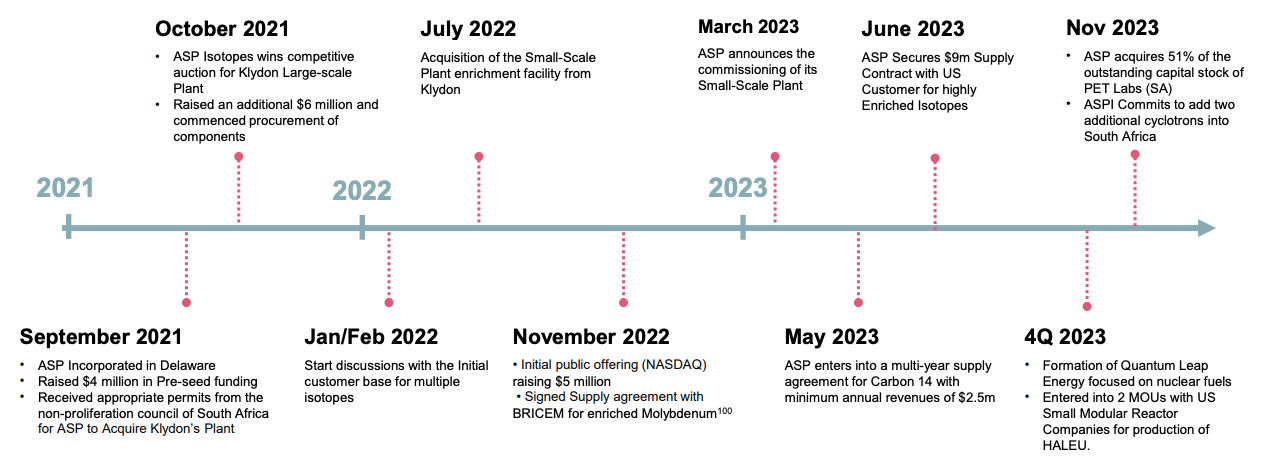

ASP Isotopes successfully acquired two incomplete ASP plants in Pretoria, South Africa, and obtained the required licenses from the nuclear regulators, including the Non-proliferation Council of South Africa, to complete construction of the plants and produce commercial product. Cold commissioning of the first manufacturing plant, capable of enriching light isotopes, was completed in Q1 2023, and ASP Isotopes entered into a Memorandum of Understanding with a North American customer for the entire offtake of the Company's first light isotope plant. The Company intends to enter into "take or pay" style offtake agreements with customers and expects to be a leading supplier of non-nuclear enriched isotopes by 2028.

ASP Isotopes has secured multiple supply agreements, including a 25-year agreement valued at up to $27 million per annum with BRICEM (Beijing Research Institute of Chemical Engineering Metallurgy) to supply highly enriched Molybdenum-100 (Mo- 100); a multi-year agreement with a Canadian company valued at $3.8 million per annum for Carbon-14 (C-14), the most frequently used radiolabel healthcare; a $9 million supply agreement with a US customer for a highly enriched isotope - customer made a $900,000 prepayment during Q3 2023 with commercial deliveries anticipated beginning in Q1 2024; and two MOUs for High Assay Low Enriched Uranium (HALEU) - $30 billion of HALEU demand expected based on initial discussions with customers. HC Wainwright initiated coverage on ASP Isotopes in December 2023 with a buy rating and updated its price target to $5.25 per share in February 2024.

Rapidly Advancing Operations

Market Data

Investment Highlights

-

Signed 25-year supply agreement valued at up to $27 million per annum

- Agreement for highly enriched Molybdenum-100 (Mo-100) with BRICEM (Beijing Research Institute of Chemical Engineering Metallurgy)

-

Signed multi-year supply agreement targeting $3.8 million revenue per annum

- Agreement for highly enriched Carbon-14 (C-14) with RC-14, a Canadian company

- Initial contract term is two years and can be extended to 10 years

-

Signed $9 million supply contract with US customer

- Received first prepayment in Q3 2023 of approximately $900,000; commercial supply of enriched isotope projected for Q1 2024

-

Signed two MOUs with small modular reactor companies to supply High Assay Low Enriched Uranium (HALEU)

- Created new subsidiary, Quantum Leap Energy LLC, to supply commercial quantities of HALEU

- $30 billion of HALEU demand expected based on initial discussions with customers

-

ASP technology is a low capital cost and environmentally friendly method of isotope production

- Enrichment facilities using ASP tech can be constructed at a fraction of cost and time vs traditional facilities with small footprint plants and modular design enabling capacity expansion

- ASP technology harvests and enriches a natural mix of isotopes without need for nuclear reactor by-products; ASP plant produces zero waste (not radioactive nor any other waste in any form)

-

Geo-political uncertainty and plant phase-outs create significant opportunity

- Planned phase-out of 9 of 10 old research nuclear reactors over next decade creates large shortfall in the global supply for Mo-99 and other isotopes

- Russia and China previously key global suppliers of isotopes; recent geopolitical events have forced governments and other customers to reassess their reliance on these suppliers

-

Highly Experienced Leadership Team

- Paul Mann, Co-Founder, Chairman, CEO, CFO; 20+ years’ experience on Wall Street investing in healthcare and chemicals companies, having worked at Soros Fund Management, Highbridge Capital Management and Morgan Stanley; began career as a research scientist at Proctor & Gamble

- Hendrik Strydom, PhD, Director, CTO; 30+ years’ experience in isotope enrichment; co-developed isotope separation technology that is backbone of ASP Isotopes

- Buy rating & $5.25 per share price target from HC Wainwright (coverage initiated in December 2023; PT updated in Feb. 2024)

Archived Webinar

RedChip Investor Group Call with ASP Isotopes (NASDAQ: ASPI)

Thursday, March 21, 2024

RedChip Investor Group Call with ASP Isotopes (NASDAQ: ASPI)

Thursday, January 11, 2024